Economic & Investment Recap

For the professional adviser community only

2022 was a year to forget, but not so much for declines in equity markets. Most of us are used to volatility in equities in the UK which is down to some extent, the weakness of Sterling and the strength of commodity crises, which aided the UK market and dampened on some of the negative returns from overseas. But it was the weakness of our low-risk assets bonds which was most notable last year, that caused lower risk portfolios to behave in a similar vein to some of the high-risk ones and that causes particular challenges for a lot of advisors. However, putting 2022 behind us, we can now hopefully look forward to 2023. There’s plenty of room for optimism.

Investors have had a huge amount to contend with over the course of last year with various factors influencing the markets. Inflation was the big topic of last year but as we move into this year, it's all going to be about recession. But then importantly for investors, there is the potential to miss out on opportunities because of all the negative signals, we're going to hear in markets, which is likely to be a big feature of 2023.

So just a quick recap, we talked about inflation quite a lot last year, but it'll be a theme which probably takes less of the focus this year. We all know that central banks have been raising rates to tackle inflation, but it looks like we're coming to the end of that rate rising cycle. So, will that mean that we get a recession or recovery? It's important to remember that each region is different. So, what's happening in the US doesn't necessarily mean the same is happening in the UK or Europe from a portfolio perspective.

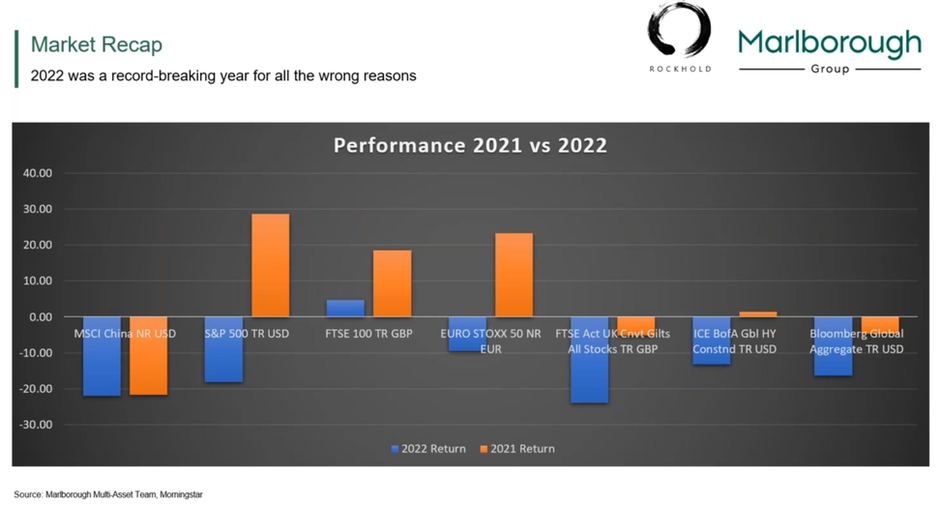

This performance bar chart shows some of the key difference asset classes or regions mapped onto the performance for 2021, just to give a little bit of context.

2022 was an absolutely terrible year for fixed income, one of the worst years on record. You can go back 100 years and there hasn’t been a year as bad for fixed income. As you can see, the blue bars are the returns for 2022 and if you look at things like UK Gilts, it shows a terrible year.

There are a couple of things to highlight from this. Firstly, looking at UK equity, UK equities have now had two positive years; back-to-back performance, and a lot of people have been talking about UK equities not from a positive perspective, but from a negative one.

But really, what tends to happen is, when you get a period of instability in markets, the UK stock market always tends to outperform. So, why is that? Why does the UK stock market always tend to outperform? and basically, it's because of the makeup of the markets.

The UK stock market tends to have more companies which do well in an environment of uncertainty. Think of an area like consumer staples, such as food produce and brewing companies. Then also, you have a lot of energy and materials in the UK stock markets who will have benefited from the rise in the oil price last year. You can see that whenever you get that uncertainty, UK stocks always tend to outperform. So don't write them off is the point there.

The other interesting piece here is if you look at Chinese equities. Now, if you look, the Chinese stock market has now underperformed for two years in a row, and that doesn't happen often. So if you do read the chart of the week, you'll see that we did do a chart which talked about the Chinese stock market and when you get two years of underperformance, the last time that happened was over 60 years ago. So, to us, that's kind of a big thing to focus on for this year, as in a potential opportunity.

Important Information

The content of the blog is an extract of a presentation delivered to professional financial advisers only. It is not intended for or written for retail consumers. The information is for information purposes only and does not contain all the information needed to make any investment decision. Please seek professional financial advice before entering into or making an investment decision.

Investments carry risk. The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested.