INVESTMENT UPDATE JULY

| INDEX | LEVEL 31ST MAY | LEVEL 30TH JUNE | CHANGE |

| S&P 500 | 4179 | 4450 | +6.5% |

| FTSE 100 | 7446 | 7513 | +1.1% |

| Euro Stoxx 600 | 451 | 460 | +2.0% |

| Nikkei 225 | 30887 | 33189 | +7.5% |

| Shanghai | 3204 | 3202 | -0.06% |

| US 10 Yr Treasury Yield | 3.63% | 3.82% | +0.19 |

| UK 10 Yr Gilt Yield | 4.17% | 4.38% | +0.21 |

| Bund 10 Yr | 2.27% | 2.39% | +0.12 |

Overview

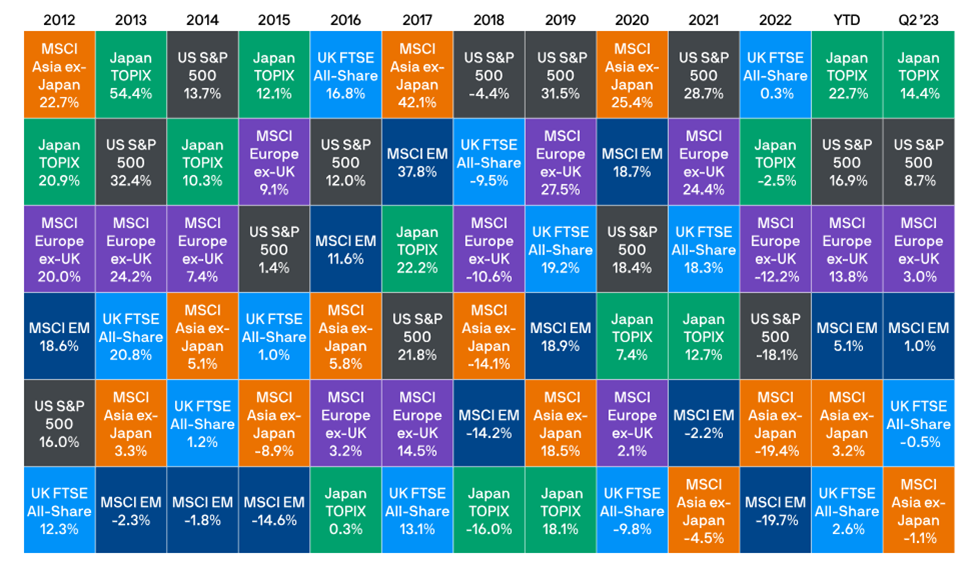

June helped to complete another strong quarter for equity markets globally and most are in positive territory this year now. The table below shows what a contradiction 2023 has been when compared to 2022, when all bar the UK returned negative results. Indeed, such has the rotation been, that the UK which was the star performer last year is now the laggard year to date – returning to a position is assumed for most periods prior to 2022. Markets are clearly looking forward now to an era of lower inflation and thus interest rates peaking and then declining. How much of this is driven by mere optimism remains to be seen.

Source: MIM 30.06.2023

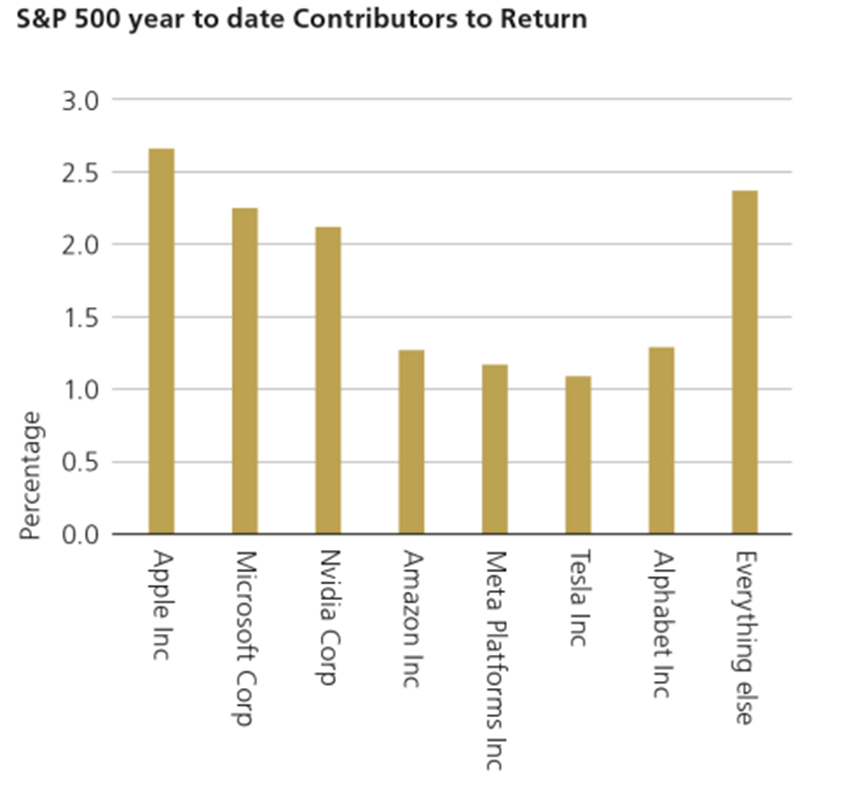

One of the startling features of the market rally in the US, has been the continued dominance of 7 ‘behemoth’ stocks in generating the returns, although June did see the market finally broaden out to a certain extent. However, the chart below shows how the returns from the US stock market have been pretty much restricted to these 7 stocks, which on their own now make up over 50% of the S&P 500 index.

Source: LGT/Bloomberg 30.06.2009

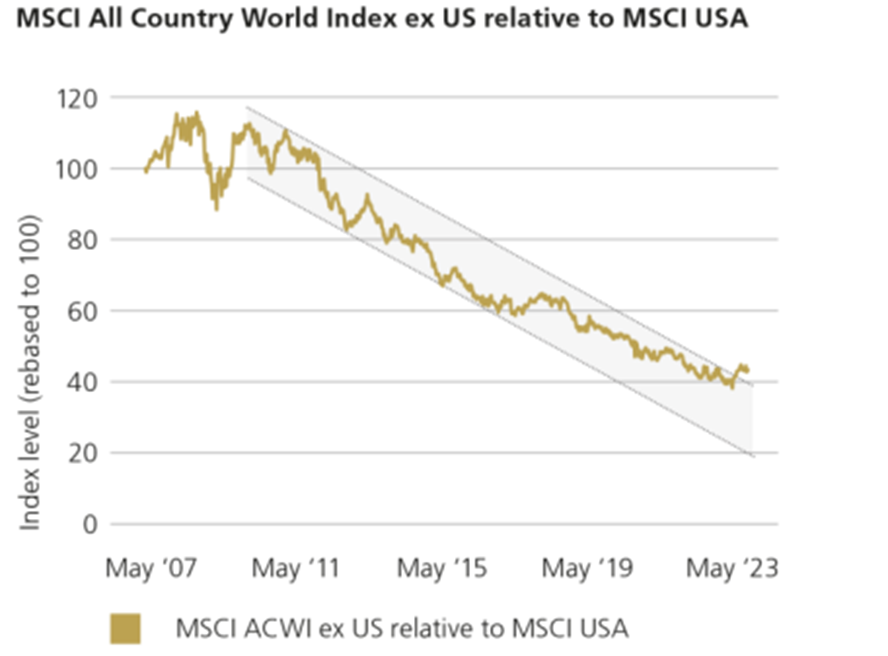

Consequently, the US market overall continues to stay relatively expensive. However, it does mean that the rest of the world markets are becoming cheaper in comparison, so opportunities may present themselves, both in other sectors of the US market or overseas. The following chart shows the performance of the rest of the world’s markets combined versus the US market. As global investors, we able to diversify our portfolios globally and thus take advantage of any of these opportunities. Indeed, our overweight exposure to Japan and that exposure’s contribution to returns helps to demonstrate this.

Source: LGT/Bloomberg 30.06.2023

On the bond front, yields continued to creep up, with 2-year yields at or above 5% in the US/UK, which seems to contradict the equity market’s optimism about near term interest rates and the economy. However, yields are now getting to the point where they are looking attractive for medium term investors, although we still have a bias to shorter dated bonds, whose prices are less sensitive to any short-term upwards movements in rates, and which will be the first to benefit from any declines in those rates. However, once we see data which suggests this is likely to occur, we are likely to increase the duration (sensitivity to interest rates) of portfolios to take advantage of this.

US

Inflation in the United States continues to fall, with the Federal Reserve’s preferred measure showing the lowest inflation rate since April 2021. Personal Consumptions Expenditure (PCE) inflation dropped to 3.8% year-on-year in May from 4.3% in April. Quarter 1 GDP was revised higher, fitting a pattern for advanced economies—slowing growth, but not catastrophically slowing. A key reason for this is middle income consumers’ resilience. Inflation for this group is less than what headline consumer price data suggests, meaning their spending power is not as weak as it appears. This coupled by an uptick in the housing market and an ongoing tight labour market could well lead to a further interest rate hike in July. That said, members of the Federal Reserve Open Markets Committee (FOMC) which sets interest rate policy are now split over the direction of travel for monetary policy.

UK

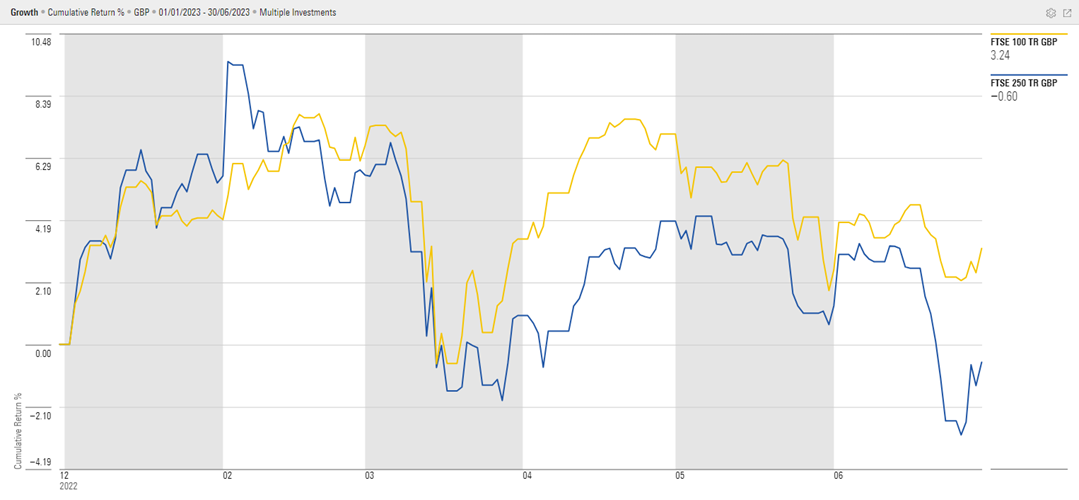

Unfortunately, the UK has its own particular set of problems, which have led to inflation becoming more entrenched than envisaged by the Bank of England. Short term bond yields now exceed 5% (remember, two years ago they were close to zero) and the UK government now has to pay more to borrow short term than Italy, which has a higher debt to GDP ratio than the UK. Consequently, this heightened, and likely increasing, environment of higher rates is more likely to tip the UK into a recession than elsewhere in the world. Manufacturing is already in a slowdown, as evidenced by the low Purchasing Managers Index at 47 (below 50 represents negative growth) and the economy is being buoyed by the dominance of services, which appear to be experiencing continued wage inflation. Wage inflation has undoubtedly been affected by the reduction in labour mobility following Brexit. However, such are the peculiarities of the juxtaposition of currencies and interest rates, that this has led to sterling strengthening against the dollar and Euro. As a net importer of goods, this should start to have impact on the cost of those imports and thus inflation. The UK stock market as a whole remains one of the cheapest in the world, although the greatest opportunities lie outside the more internationally focussed FTSE 100 and the more domestically orientated mid-cap market, whose performance this year is probably more reflective of the economic environment here.

Source: Morningstar

Europe

The European Central Bank (ECB) increased rates by 25 basis points in June, bringing the deposit rate to 3.5%, which is a 22 year high. The ECB President Christine Lagarde indicated at the ECB Forum on Central Banking that peak interest rates are unlikely to be reached anytime soon as inflation looks set to stay higher for longer. The economic slowdown has arguably kicked off, with German manufacturing turning down decisively.

That said, the inflation rate dropped in May to 6.1%, from 7% in April but it does remain significantly above the 2% target of the European Central Bank (ECB) and with wage growth pressures this may remain the case for some time. Core inflation which tends to be stickier has now declined for two consecutive months, falling to 5.3% in May from 5.6% in April.

In Russia, a rebellion by Wagner mercenary group towards the end of June was short lived, Russian warlord Yevgeny Prigozhin and his troops reached a deal with Moscow ending the armed uprising after they threatened to advance on Moscow.

Japan

June saw 2023 Q1 GDP figures (Quarter on quarter Annualized) revised sharply up from 1.6% to 2.7%. Full year projections for growth in the economy are 1.8%. The Bank of Japan maintains its ultra loose monetary policy as other central banks continue to tighten. This continues to weaken the currency and strengthens exporting for the country. Unemployment remained unchanged at 2.6%.

The government are making a huge push to get households to invest in domestic stock markets, as over 55% of Japanese household savings is held in currency or cash deposits. By launching a tax-free stock account (very similar to an ISA) called a NISA, hopefully encouraging people to participate and increase their wealth at the same time.

Asia and Emerging Markets

Asia and Emerging Markets both ended the first half of the day slightly positive, though they were the lowest performing equity regions. The China recovery has continued to disappoint, with retail sales decelerating, as did industrial production. The People’s Bank of China (PBOC) continued to announce measures to support the economy and there is expectation this will be positive for equity markets.

Outside of Asia, Latin America was the strongest performing region in Emerging Markets.

Outlook

Equity valuations are high in US which, coupled with modest earnings growth expectations, are where dangers lie for market progress. The equity market has moved mechanically higher with no imminent sign of a recession. Apart from Japan, in which the data still appears to have some residual momentum, all economies tracked display a degree of weakness. Were it not for the pandemic-era accumulated savings, the OECD would doubtless be in recession. Should central banks continue their present path of aggressive tightening and stringent quantitative tightening; a recession will unfold – this view remains consistent for now, but of course will be updated as the facts unfold. The fixed income market and a long list of credible supporting data insist upon the economic slowdown unfolding, as historically shorter dated bond yields higher than longer dated ones, suggests recession. As previously stated, the moment has not yet arrived when we can allocate to long dated fixed income and despite economic indicators pointing overwhelmingly to a slowdown a so-called soft landing should not be totally discounted if consumers keep spending, driving corporate earnings and economies muddle through despite the headwinds.

Rockhold Asset Management, with contribution from Alpha Beta Partners, LGT and Marlborough, July 2023

Your Capital is at risk. Past performance is not a reliable indicator of future results. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances. Your capital is at risk and the value of investments, as well as the income from them, can go down as well as up and you may not recover the amount of your original investment.

.webp)