Recession Ahead?

For the professional adviser community only

The key reason that markets were selling off last year, has now changed. It's now gone away. So, now inflation is less of a problem, the key thing that people are going to focus on is recession and this could be challenging for investors, because what you're going to find this year is there's going to be a lot of talk about recession.

Now, if you're having conversations with clients, how difficult will it be to convince clients that this is a good time to invest when they're reading in the newspaper that we're heading for a recession? From their perspective, they'll think, why would I want to invest, if we're heading for a recession? But as we all know, stock markets are always looking forward. So, there are a couple of things to say on this.

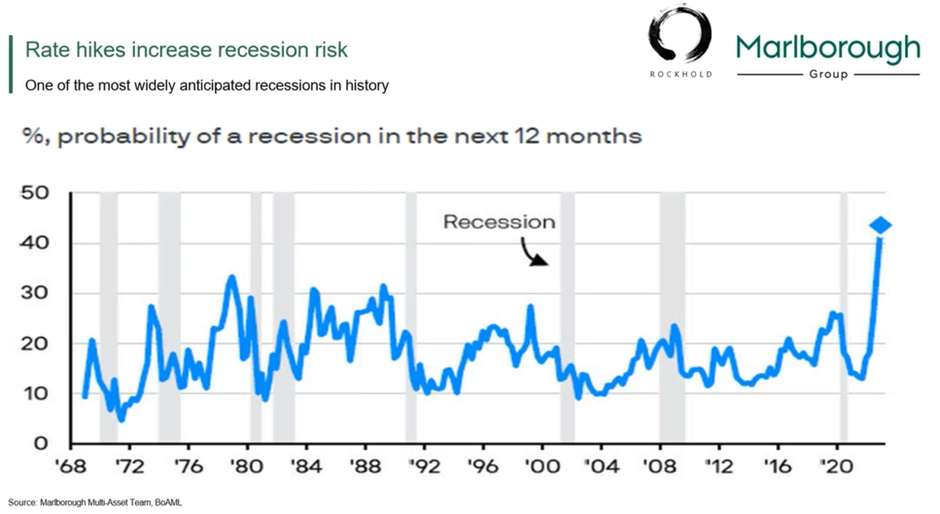

Firstly, this is a graph showing you the probability that we head into a recession. Now the point about this chart is if you go back over history, this looks like the most well flagged recession in history. Everybody thinks we're headed for a recession, and often if everybody thinks we're headed for something, it probably won't happen.

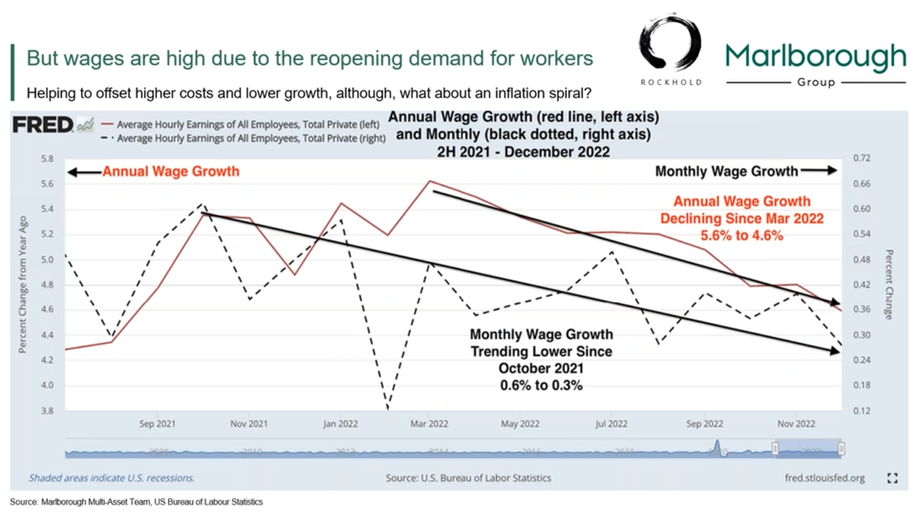

So what we have is, we had lots of inflation, central banks raised interest rates to bring down that inflation and a lot of people were questioning, Will we get this inflation spiral? Because what we have at the moment is we have a lot of people going on strike, demanding higher wages to compensate for inflation. The problem with that is if you get people obviously demanding higher wages to compensate for inflation, then it means they can actually cope with higher prices if they get higher wages.

So, therefore, that doesn't tackle inflation because they spend, then the price of products goes up. They ask for more pay rises and they spend, and the price of products go up. So you get this inflation spiral so that was a big concern that inflation gets out of control. What we're looking at here is actually it's showing you wage growth and this is just looking at the US. But you can take this as a barometer for everywhere. What you're seeing is that wage growth is actually coming down so, we've been coming out of a period, which is like no other, Covid, you've had the whole globe shutdown, the whole globe then re-opened, you've got a lot of people who got other jobs during covid, got displaced, moved to different locations etc. So, when the economy re-opened you didn't have enough workers to fulfil specific jobs. So companies started to pay up as they needed to get the workers in because they’ve got the demand for the product.

So as a result of that, you saw a spike in wage inflation. Now, from your client's perspective, they'll be reading about everybody going on strike, and this will be a concern, too. But what we would say to this is that the number of people who are unionised versus the eighties is a lot lower today and the majority of people actually work in the service sector and the majority of those people have an annual pay review, and that pay rise tends to be 2% to 3% that's kind of just consistent over time.

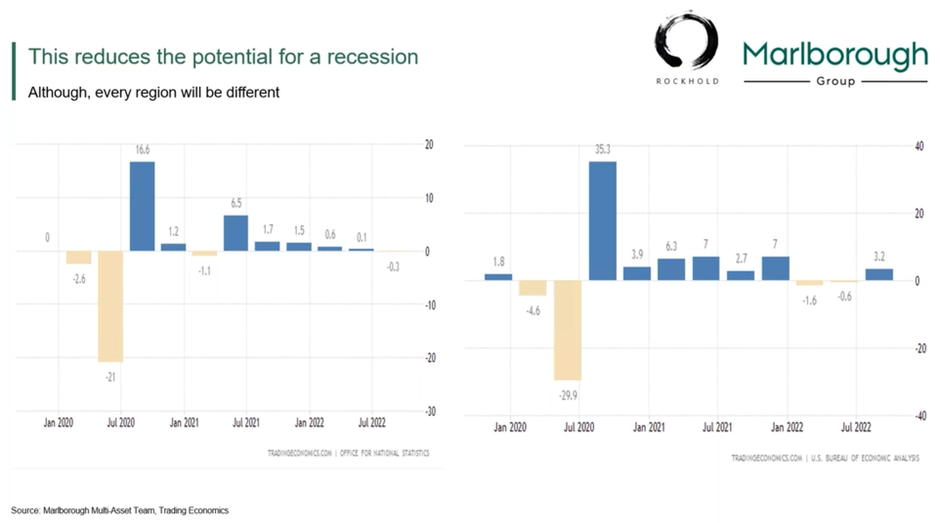

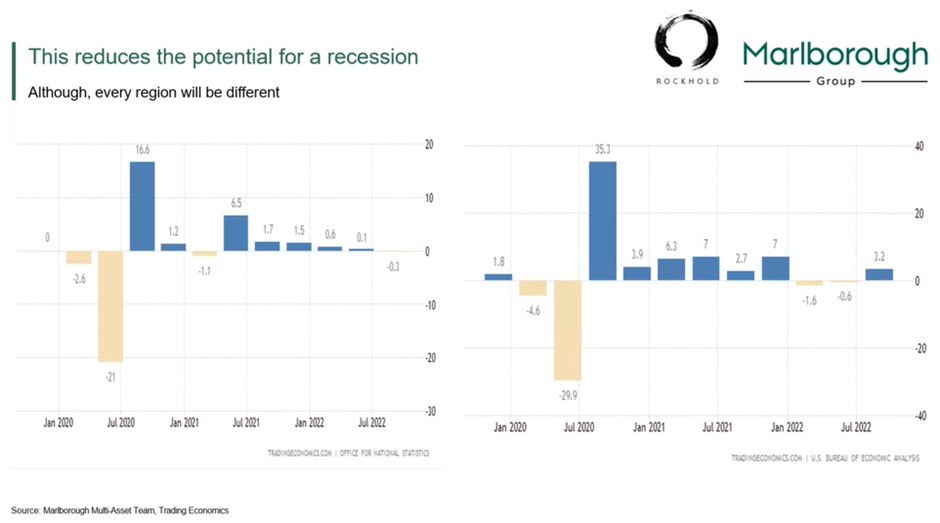

So the question around recession, are we headed for a recession? On the left-hand side, you see GDP growth in the UK, on the right-hand side, GDP growth in the US. So, what we can see here is that the last quarterly print for gross domestic product or growth in the UK came in slightly negative.

The definition of a recession is too quarters of negative GDP growth. We get GDP figures out in the UK in early February and that will give us confirmation if we are in a technical recession or not in the UK. But the point is, does it actually matter? Why would we say that? Because, if you look at the level of growth that we've had in the UK, it's been quite low. The point is that if the economy does contract, but only moderately, shallow recession, the market is not going to care because that's already priced in, the market is expecting a recession.

As already stated, this is the most well flagged recession in history, so everybody is expecting it so it's already in the price.

Now the point being, if this is a moderate recession, then actually it's likely that equity's go up, not down. So, you would have to see a deep recession for equities actually to move to the downside from here, actually, if we get a moderate recession that it's not going to be a problem, nobody's going to really care, and the market will move on.

The other point is that you actually had a recession in the US, so you can have periods where you have a shallow recession, and the market can bounce back quite quickly as well.

There's so much happening in markets today, you've got high inflation, you've got increasing interest rates, you're coming out of Covid, and I think those two things are competing against each other, so this isn't your average market cycle where you have interest rates going up and growth coming down. You have all of this pent-up demand from people not being able to consume in the way that they did for a period of two years

China is just coming out of Covid restrictions. They’re one of the biggest consumers globally and that will impact lots of regions because they feed into China so that economy will re-open and that will benefit a lot of regions.

And the other saying, well, that didn't happen, actually, let's revise growth up. From your client's perspective, recession, recession, recession, that's bad news, psychologically you're telling them, this is a great time to invest. There lies the challenge.

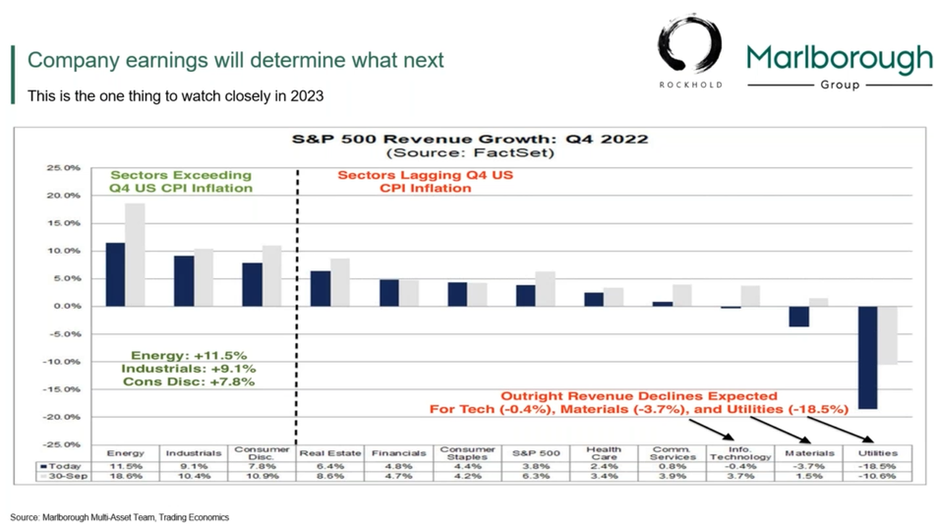

The thing that people are going to start to focus on is company earnings. So, what this chart shows you here is the expectation for company earnings in Q4, in the US. So, every quarter, companies in the US, they report their earnings and what happens is the companies will try to manage expectations. So, if you're rich, go back to September 30th, which is the very bottom line. That's the level of earnings that was expected from each of the sectors in the US. So, energy was expected to deliver earnings of 18.6%. It's a big number. The S&P on average was expected to deliver earnings of 6.3%, but you can see that the chart shows that’s changed in only a day or two. That dynamic has already changed, and companies are expecting that their earnings will be lower.

The reason that is, is because, obviously, you have had inflation, which has resulted in higher interest rates, higher interest rates impact the profitability for companies, because their financing cost increases.

So, what do companies do? They try to manage this. They know this is coming, and you'll see that there's been a lot of layoffs by a lot of companies because they're trying to manage their earnings, so they can reduce their fixed cost so that their earnings don't move too much.

Again, the earnings haven't been as bad as expected and, again, if we look at things like the information technology sector, earnings are expected to be slightly negative, but that sector is very much impacted by currency because over 50% of the earnings that's generated by that sector is overseas, and you've had a massive move in the US dollar over the last quarter was over 8%, so, that will impact their profits but that's going to stabilise. So, you will see quick bounces back in some of these, too.

Thus, the key focus this year will be earnings on what that means for markets, but by all accounts, it actually hasn't been as bad as expected and the reality is, it's all priced in.

Important Information

The content of the blog is an extract of a presentation delivered to professional financial advisers only. It is not intended for or written for retail consumers. The information is for information purposes only and does not contain all the information needed to make any investment decision. Please seek professional financial advice before entering into or making an investment decision.

Investments carry risk. The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested.