INVESTMENT UPDATE MAY

| INDEX | LEVEL 31ST MARCH | LEVEL 30TH APRIL | CHANGE |

| S&P 500 | 4109 | 4169 | +1.46% |

| FTSE 100 | 7631 | 7870 | +3.13% |

| Euro Stoxx 600 | 457 | 466 | +1.96% |

| Shanghai | 3272 | 3950 | +2.83% |

| US 10 Yr Treasury Yield | 3.49% | 3.45% | -0.04 |

| UK 10 Yr Gilt Yield | 3.46% | 3.72% | +0.26 |

| Bund 10 Yr | 2.31% | 2.32% | -0.01 |

Overview

April saw a continuation of the knock-on effect from the demise of Silicon Valley Bank, with J P Morgan Chase buying First Republic Bank, whose shares had been sold off as depositors worried about the bank’s business model in the wake of rising interest rates in the US. Due to the digitalisation of finance, the speed at which bank runs can happen today is incredible. As Goldman Sachs noted, in 2008, it took 9 days for Washington Mutual to lose $18bn in deposits. In 2023, it took 4 hours for Silicon Valley Bank to lose $42bn of deposits! However, the impact of this on financial markets was quite muted. One positive is that the possible impact on lending resulting from the problems with small banks could have the effect of reducing GDP, which in turn could reduce the pressure on the US Federal Reserve (the ‘Fed’) to increase interest rates. Indeed, much of the speculation during the month was about the length of the higher interest rate cycle and its possible reversal.

US

As previously mentioned, much of the focus in the US was on inflation and the interest rate cycle. The US inflation rate for March came in at 5%, a slight increase of 0.1% on the previous month, but it should be membered that inflation at one point was 9.1%. We are still some way off the Fed’s target inflation rate of 2%, but we also saw US GDP fall to 1.1%, from 2.6%. A slowdown in the economy was to be expected following the Fed’s actions since early 2022 and this is one of the indicators they use to judge if the economy is cooling, so again could take pressure off the need for future rate rises.

We also entered Q1 earnings season and although earnings estimates have been declining by around 6%, we did see the majority of companies reporting earnings ahead of expectations. In many cases, this was a result of improving margins, either from price increases or reduction in costs and not necessarily from growing demand.

Whilst the US equity market has appeared buoyant, it should be noted that so far this year 86% of the returns of the S&P 500 index have come from just 10 ‘mega-cap’ large stocks, so we should be wary of getting too bullish at this stage. It also needs to be remembered that the US market is still expensive, compared to its historical average and it follows that if earnings decline, then any forward price movement will simply result in them becoming more expensive. The chart below shows the historic valuation of the US market. One doesn’t need to understand the methodology of a price/earnings (p/e) ratio to understand that it is at the high end of the range, but safe to say, the higher the number the more expensive the market is:

Source: mulptl.com 04/05/2023

Source: mulptl.com 04/05/2023

The Treasury General Account which operates akin to a current account for the US Government will require “topping up” likely around mid-summer. Also known as the extension of the debt ceiling, this is usually a political pantomime played out in Congress but has always been agreed to, to avoid a US default. There is likely to be drama in 2023 but raising the debt ceiling is inevitable, otherwise a default scenario is the result. An ongoing theme is the likelihood for the US dollar to weaken as interest rates begin to fall and GDP weakens further – the hedging strategy implemented in certain US funds held has worked well so far and there may be more to come.

UK

Domestically, the UK continues to struggle with inflation at higher levels, with March’s figure coming in at 10.1% versus 10.4% the month before, which was disappointing compared to other areas of the world. However, the figure is expected to come down significantly when the next level is released, as the huge energy price increase in March 2022 drops out. However, like the US we will still be some way off the target rate of 2%. Therefore, UK interest rates are set to travel higher to suppress demand and control rising prices. Dependent upon conditions, the UK stock market skew to banks, commodities and pharmaceuticals is a blessing (because it has performed well in the short term) or a curse (as you are exposed to a narrow range of sectors) and performance results accordingly. The absence of larger technology companies is notable, but valuations remain appealing.

Europe

There was a similar picture in Europe as seen elsewhere in that markets were buoyant on expectations that the peak in European Central Bank (ECB) rate rises is in sight. Indeed, European markets as a whole have been the best performing this year. This is partly to do with the continued rebound in sentiment caused by the continued decline in energy prices following the Russian invasion of Ukraine, even though inflation, like elsewhere, remains well above the ECB’s target. Eurozone business activity expanded faster than expected led by demand and the easing input price pressures, albeit led by services rather than manufacturing. The Purchasing Managers Index (PMI), which represents business activity (over 50 is positive), came in at an 11-month high of 54.4, up from the previous month’s 53.7. Valuations remain attractive relative to the US, but the interest cycle is likely to lag that of the US.

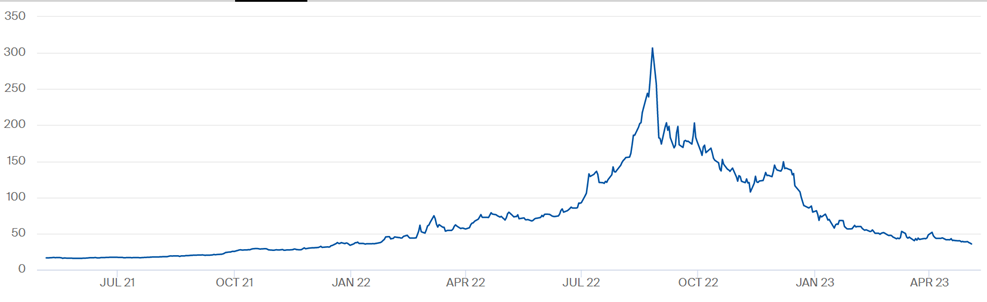

European Natural Gas Prices Continue to Decline

Source: ICE 05/04/2023

Asia

China and the emerging world remain attractive at valuation levels, but stock markets have not fulfilled their promise so far. The so-called post Covid economic reopening of China continues unabated and demand for hard commodities is escalating whilst GDP is expansionary. Stock performance is likely to follow, although the yuan has softened. Meanwhile a more positive view of Japan is forming following the prima facie subtle changes in policy at the Bank of Japan. Mr Ueda the new BoJ Governor took office seamlessly, as expected. Data dependency rather than forward guidance is likely to mean higher interest rates and a firmer yen versus the dollar as Japanese inflation crawls higher. Japanese core inflation around 3% and wage settlements around 4% marks significant change after multi-decade deflation. Higher yields on Japanese Government Bonds and prospects for equity growth will encourage active Japanese global investors to repatriate funds for domestic opportunities.

Outlook

Overall, it is pleasing to see markets moving in a positive direction. However, there is still a defensive positioning in portfolios, as we wait to see how the rapid increases in interest rates affect economic growth and earnings, particularly in the US where, as mentioned earlier, valuations remain stretched. It is expected that exposure to shorter dated US bonds will be increased during May, as the end of the tightening cycle comes into view. This will be accompanied by a reduction in inflation linked securities, as we see peak inflation occurring.

Rockhold Asset Management, with contribution from Alpha Beta Partners and Marlborough, May 2023

.webp)