BACK TO LONG TERM INVESTING

The purpose of this article is to provide the freedom to “zoom-out” and look a little further towards the horizon than we might be able to do from a monthly investment report perspective. Something further sighted and strategic than the typical “view from the bridge”. There are clear risks in doing so and we evoke the quotation from Winston Churchill, “When the facts change, I change my mind. What do you do?”

Today, investors face crosswinds from diverse sources. Central banks are winding down their unorthodox monetary policies. Governments are less hesitant about deficit spending. Geopolitical tensions are ever present on a multi-regional basis. Thus, the global economy is braced for various shifts that are laced with layers of uncertainty. As ever, in uncertain times, the dominant tendency is to go back to basics. As this decade has progressed, long-term investing has been side-lined, as asset prices have increasingly deviated from their 'fair value'. However, long-term investing is likely to stage a comeback, as investors transition to a new regime where prices gradually reconnect with their fundamentals as volatility rises. We also turn the spotlight on how Environmental, Social and Governance (ESG) investing and long-term investing are morphing. First a retrospective.

The biggest threat to capitalism in over a century resulted from within – a heady cocktail of toxic debt instruments famously sunk Lehman Brothers and conspired to deliver the Global Financial Crisis (GFC) of 2008-9. Thanks to emergency interest rates and the timely invention of a new economic antidote called quantitative easing (QE -which involved central banks buying their own government debt and lowering interest rates, thus freeing up capital to be deployed elsewhere in the economy) the world did recover from the GFC. However, it took around a decade to do so. Emergency low interest rates and accommodative fiscal policies propelled risk assets to higher levels and those with wealth grew wealthier.

QE’s planned withdrawal had just got underway when we were struck by the first pandemic in 100 years. Once again emergency interest rates were dusted down and implemented along with greater than ever before levels of QE. Central bank balance sheets inflated faster than had previously been imagined. An economic slump was avoided, asset prices were pushed higher again with valuations at stratospheric levels. Furlough schemes and stimulus cheques were issued to ordinary people who were told not to go to work. All at a time when the delivery of goods and services were constrained by lockdowns and transportation bottle necks. The unpalatable side effect was to awaken the inflation dragon from a 40-year slumber. Inflation roared back across the world provoked hotter still by Vladimir Putin’s Russia who weaponised energy supplies to the West and who continues to wage war against the people of Ukraine and an economic war further afield.

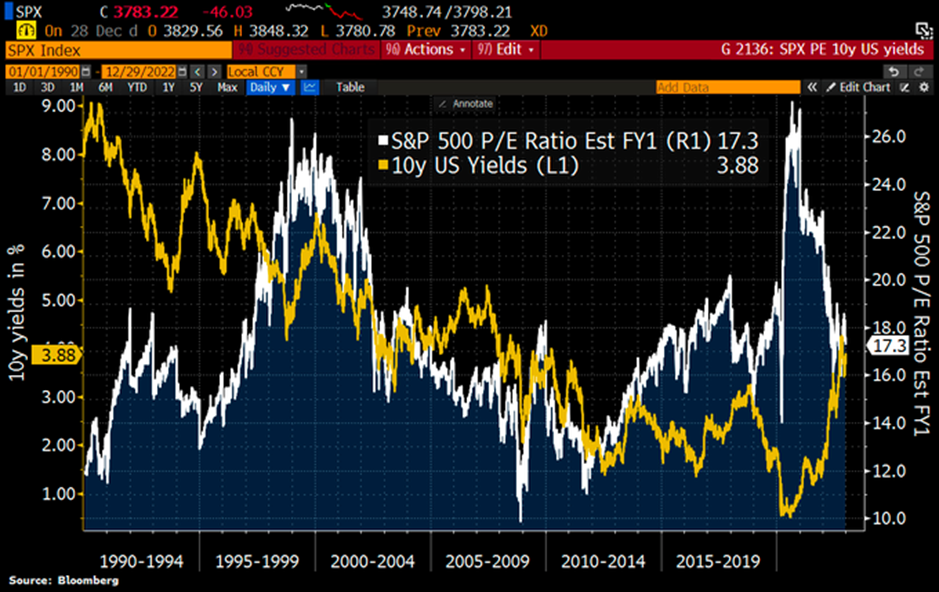

The hangover from central bank medicine applied in copious quantities is where we find ourselves today. Valuations on equities are finding a natural level whilst bond yields are positive and interest rates moving back to levels last seen decades before. For many this is tough indeed and whilst we believe much of the unwinding of excess has occurred, there is a little further to travel. So, as we “zoom-out” and cast our stare to the economic horizon, what do we see?

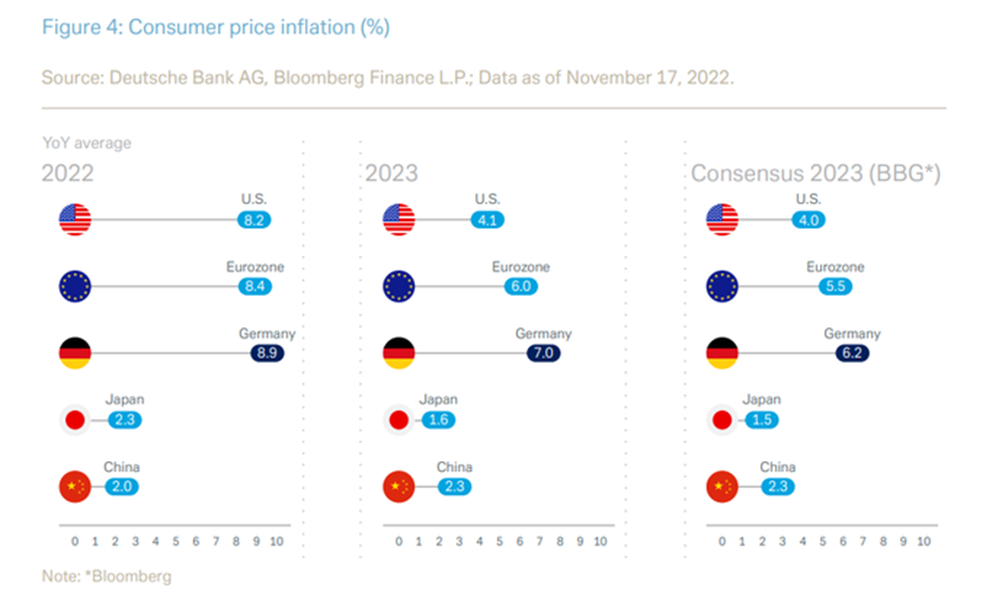

Let’s begin with inflation – we consider US inflation to have peaked and we anticipate a steep decline in headline numbers, notably Personal Consumer Expenditure (PCE) inflation (the more regular central bank measure). The Consumer Prices Index (CPI) measure which incorporates a large element of “shelter” costs, such as owner equivalent rents should also decline albeit lagging. The reopening of China’s economy could create a further pull-down in inflation as cheap exports recommence once more. However, we are more persuaded by the likelihood that demand for industrial commodities, including oil, will keep pressure on prices and the onshoring/near shoring trend that has begun will likely persist with higher costs of production the corollary. Inflation is notably difficult to gauge through the fog into the far distance. However, we anticipate inflation significantly lower than recent 40-year highs, but we envisage inflation structurally higher over the medium term than the near zero figures we have been used to for the past number of years. This of course triggers a view across the asset class spectrum.

Source: Deutsche and Bloomberg, December 2022

Where monetarist policies are deployed to control inflation, it must surely follow that rates will trend lower over time as headline inflation falls. Central bankers’ and Finance Ministers’ most potent weapon is credibility with markets. Former Fed’ Chairman Ben Bernanke famously said. “Monetary policy is 98% talking and 2% action.” Where credibility is lost, havoc often ensues – there are various case studies to make this point, although Argentina springs to mind as does the UK mini-Budget of 2022. The Federal Reserve, the most powerful central bank on earth, is likely to hold rates higher during 2023 until it is persuaded the runaway inflation dragon is slayed. Jerome Powell remains fixated on this goal, quoting Paul Volcker, whom he clearly admires and who brutally defeated inflation in the 1980s.

We do envisage a pivot in rates to a downward direction later during 2023 but, like inflation over the long run, we see rates sitting structurally higher than the emergency levels they have been stuck at for many years post GFC and again during the pandemic years. Annuities are once again a legitimate consideration for retirees of a certain age and Money Market deposits and short dated bonds offer refuge for defensively minded investors.

The phenomenon of US dollar strength has been one bright point for investors during 2022. The reserve currency status bringing a buoyancy aid to globally invested portfolios. The shorter-term knock-on for the US dollar is likely to be a weakening from its historic highs relative to other currencies once market volatility softens. Again though, we envisage the Greenback remaining robust for the foreseeable future as the Chinese Yuan slowly builds a challenge over time.

Quantitative easing since it was first used in Japan during the early 2000’s has become a potent tool employed by central banks to stimulate economic growth when interest rates are already set very low. QE is finally being withdrawn and in fact liquidity is being sucked out from economies by quantitative tightening. This is set to continue in America, Europe, and UK. QE is now an ever-present option in the central bankers’ tool kit and whilst its use has presently served its purpose, we would certainly not rule out tactical use in future.

Higher rates, QE and economic stimuli withdrawal coupled with an economic slowdown are all tools used to defeat inflation. This combination allied with a rapidly softening housing market and the early evidence of layoffs by employers leads us to conclude a recession in 2023 across major global economies is now a central case scenario. The US Conference Board leading indicator index has a 100% accuracy rate for anticipating recessions in America as shown below in a chart from one of our research partners. When the year-on-year change turns negative for 2 or more consecutive months the proximity of a recession is typically around 7 months distant. This equates to a possible US recession during the early part of this year which will in turn encourage a pivot in interest rate policy. Meanwhile we do anticipate some company earnings being disrupted by falling demand provoked by the economic slowdown. Other corporates will continue to prosper as their goods and services are considered staples. Those goods and service providers towards the base of Maslow’s hierarchy of needs pyramid are likely to fair the best.

Source: The Macro Compass, December 2022

Equity prices are likely to correct lower pushed down by the expectation of weaker earnings. Once this pattern and a valuation point confirms a floor is in place, we are likely to become active buyers as the equity market re-enters a cyclical upswing.

The all-important fixed income market has witnessed a rollercoaster ride in recent years. Yields pushed into negative territory across the world by central bank action and then correcting higher based on QE withdrawal, higher rates all after a 40-year bull market for the asset class. Of course, this culminated with a positive correlation to equities at quite the worst time during 2022 leaving low risk multi asset investors in sour mood and provoking the worst performance for the staple 60/40 portfolio in over 100-years. The better news is that we envisage a return to relative normality in terms of their equity correlation with bonds as short-term interest rates begin the fall along with short tenor bond yields and thereafter the yield curve resuming a more typical shape. The long-term role of fixed income as an effective equity hedge in mixed asset portfolios resumes over the long run.

Source: Bloomberg December 2022

Energy policy, or rather the lack of anything worthy of the name, has been something to create a hearty debate in recent years. Following the global slowdown and as economies pick up, we do envisage a potential energy demand inflection point. We are avid fans of renewable sources but despite extensive roll-out there is no coordinated strategy to deliver the super-critical base load. The energy that provides the backbone of power generation when the wind does not blow and when the sun is not shining. The actions of Vladimir Putin brought the danger and folly of such a policy vacuum into sharp relief during 2022 and had been clearly warned against by the provocative President Trump, alas to no avail.

Source: Getty Images June 2018.

Germany prematurely shut down her nuclear facilities offering herself up to Russian gas as the sole base load supplier. When war in Ukraine ensued and Putin began weaponising natural gas Germany was forced to re-open coal-powered energy production and classified biomass energy as “zero carbon” although it involved felling trees in Canada and shipping them across the Atlantic to Germany for production into heating pellets to be burned in furnaces. We envisage a step up in modern nuclear energy production across developed markets which will enable us to make progress towards net-zero targets and provide base load security. This is not an instant fix and will roll out over years, allowing for a strategic investment opportunity. While much maligned and misunderstood (populace response to Chernobyl, Fukushima etc) modern nuclear energy facilities and production are very safe with a carbon neutral footprint. In this regard China. India, Pakistan, and South Korea are ahead of the pack, and we expect to see a step-change in Western nations with knock-on demand for related commodities including uranium. Energy is just one theme we are keen to explore within appropriate portfolios in future.

Demographics is of course relevant and important. We note India’s emergence into the global economic premier league surpassing UK in terms of GDP output, ranked 5th largest economy in the world and soon to surpass China as the world’s most populous nation, with more than 1.4 billion inhabitants. 4 of the world’s fastest growing nations between now and 2050 will be found in Africa.

Geopolitics has shaped 2022 and will remain the one notable aspect of global investment strategy that cannot be modelled. We expect the war in Ukraine to persist for some time yet, notwithstanding a momentous change of policy or leadership in Russia. China’s over indebted property sector, shrinking population and faltering urban migration programme weighs on its ambition to become the dominant world economic leader. The West has begun to repatriate some manufacturing all of which cumulatively may stimulate China to invade Taiwan to seize semiconductor knowhow and re-establish itself with its own people and the Pacific region. We maintain vigilant observation.

We hope this article provides a strategic forward view – it is not intended to be an exhaustive study of our investment foresight, rather offering some informative snapshots of themes, opportunities, and threats we are perhaps likely to encounter as we move forwards into what certainly resembles a new investment regime. A different investment landscape to the one we have inhabited largely since the employment of massive central bank interventions post 2008. In many ways we identify a regime supportive of “back to long term investing” and we shall be all the better for it.

Written by the Alpha Beta Partners Investment Team.

All market data sources are Bloomberg December 2022 unless otherwise stated.

.webp)